Home Loan EMI Calculator is a financial tool that helps to calculate the EMI (or equated monthly installment) paid by the borrower to the bank against the home loan taken from the bank for a specified period.

(Calculate the EMI against the Home Loan taken from the bank by using this Home Loan EMI Calculator)

If you are planning to buy a house and if you don’t have ready cash at your disposal, bank loans help you to realise your dream. These bank loans can be repaid on a monthly basis in easy installments along with a small interest. This Free Home Loan calculator is a finance tool that will help you calculate monthly EMI as well as EMI interest payment on home loans.

Information about Home Loan EMI Calculator:

Home Loan EMI Calculator is a financial tool that helps to calculate the EMI (or equated monthly installment) paid by the borrower to the bank against the home loan taken from the bank or other financial institutions for a specified period.

Home Loan EMI Calculator is used to calculate the EMI on home loan taken from any banks like SBI, PNB, ICICI, HDFC, BoB, etc. This Home Loan EMI Calculator requires some data like – Your Principal Amount took from bank, Rate of Interest & Period (in No. of Months). After calculation, you will get the Equated Monthly Installments (EMI).

What is Equated Monthly Installment (EMI)?

Equated Monthly Installment – EMI for short – is the amount payable every month to the bank or any other financial institution until the loan amount is fully paid off. It consists of the interest on loan as well as part of the principal amount to be repaid.

The interest component of the EMI would be larger during the initial months and gradually reduce with each payment. The exact percentage allocated towards payment of the principal depends on the interest rate. Even though your monthly EMI payment won’t change, the proportion of principal and interest components will change with time. With each successive payment, you’ll pay more towards the principal and less in interest.

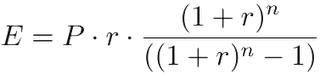

Here’s the formula to calculate EMI:

where:

E is EMI

P is Principal Loan Amount

r is the rate of interest calculated on a monthly basis. (i.e., r = Rate of Annual interest/12/100. If rate of interest is 10.5% per annum, then r = 10.5/12/100=0.00875)

n is loan term/tenure/duration in number of months

What is Home Loan EMI?

EMI is the abbreviation for Equated Monthly Installment. Home Loan EMI is the monthly repayment that the borrower should make to repay the home loan as per amortisation schedule.

How are the borrowed amount and interest due paid through Home Loan EMIs?

Each EMI repays a part of the principal i.e. the borrowed amount and the interest due on the borrowed amount. The proportion of each loan EMI utilised for repayment of principal and interest, however, varies over time.

Banks and financial institutions, in general, calculate Home Loan EMI through a common mathematical formula. Thus, for a given loan amount, tenure and interest rate, the EMI calculated and the amortisation schedule offered by banks and Non-Banking Financial Companies (NBFCs) will typically be similar. This means that pattern of reduction of principal amount through the payment of each EMI will typically follow a similar trend across all financial institutions.

It is a well-known fact that the initial EMIs contribute more towards payment of interest due as compared to the principal amount. However, during the tenure of the loan, subsequent EMIs contribute more towards repayment of the principal amount as compared to previous EMIs.

What is the benefit of calculating the Home Loan EMI?

Since EMI is the fixed amount that you will need to pay to the bank towards repayment of your Loan, calculating the home loan EMI helps you to plan your monthly budget.

What is the impact of part payments on EMI?

Part payments reduce the outstanding loan amount, which in turn reduces the interest amount due. Without changing the EMI post part payment, the contribution of EMI towards principal repayment increases. Thus the loan gets repaid faster.

Home Loan Calculator Variables:

This Loan Calculator for home loan uses four different variables that most of the calculator requires. These Home Loan EMI calculator variables are:

Principal Loan Amount: This is the amount borrowed by a borrower from the bank. If you apply for a higher loan amount, your monthly EMI will be high.

Rate of Interest: The Rate of Interest is the variable of the loan calculator that appears as a percentage and is different for different types of loans.

Loan Period: This is the period in which you can repay your loan. Longer loan tenure means lower housing loan EMI.

Equated Monthly Installments (EMI): Equated Monthly Installment or EMI is the amount payable every month to the bank or any other financial institution until the home loan amount is fully paid off. It consists of the interest on loan as well as part of the principal amount to be repaid.

How to use the Home Loan EMI Calculator?

To use the Home Loan calculator, by simply entering the loan amount, interest rate, and select the loan tenure.

The EMI calculator will show the EMIs based on the entered numbers instantly. It will change as per modification.

Anyone can calculate his EMI against the Loan through this online home loan EMI calculator available on this page with high accuracy.

Following are the steps to calculate the EMI through this calculator:

- Step 1: Enter the Principal Loan Amount that he wants to borrow from the bank as a loan.

- Step 2: After this, fill the rate of interest of the loan he gets from his bank or financial institution. The rate of interest appears as a percentage and is different for different types of loans.

- Step 3: The next step that one has to follow is to select the period for a loan in months. This is the period in which you can repay your home loan. Longer loan tenure means lower loan EMI.

- Step 4: Thereafter putting all the above data, click the calculate button for calculation of EMI.

- Step 5: After submitting all variables required by an EMI calculator, one will get the Equated Monthly Installment or EMI against the Loan.

Home Loan EMI Calculator Formula:

Here’s the formula to calculate Home Loan EMI:

where:

E is EMI

P is Principal Loan Amount

r is the rate of interest calculated on a monthly basis. (i.e., r = Rate of Annual interest/12/100. If rate of interest is 10.5% per annum, then r = 10.5/12/100=0.00875)

n is loan term/tenure/duration in number of months

Home Loan Interest Rate Calculator:

Home loan interest rate Calculator online can help you calculate the interest rate you are eligible for and also, the total interest you will pay during the loan duration. Some of the factors that are used for interest rate calculation are:

- Occupation of the borrowers: Banks charge a slightly higher interest rate on home loans for self-employed as compared to that on loans for salaried borrowers.

- Amount of the Loan: This is the amount borrowed by a borrower from the bank.

- Type of loan opted for: The bank also offers different rates on its various loan schemes such as Existing Loan Borrowers, Existing Term Deposit Customers, Professional & Self Employed, NRIs, etc.

- Existing bank customers: Banks also offer lower interest to their existing bank account holders to maintain its relationship.

Advantages of using this Home Loan Calculator:

There are several advantages attached to using this online Home Loan EMI calculator, which other such calculators may not provide.

Advantages of this EMI calculator are:

- Shows the results based on the fractional rate of interest.

- It helps you save time by showing the results immediately.

- It is more accurate compared to other EMI calculators.

- It helps you to determine the loan amount and tenor.

Using an EMI calculator is one of the first steps you take to apply for a home loan. The next steps involve arranging all the necessary documents and making sure you fulfill all the eligibility criteria.

You are here to calculate the EMI (or equated monthly installment) paid by the borrower to the bank against the loan taken from Bank. Calculate the Loan EMI by using this online Online Home Loan EMI Calculator.

FAQs about Home Loan EMI Calculator:

Why should I calculate Home loan EMI before taking a loan?

It is advised to calculate home loan EMI before taking a home loan. There are several benefits of calculating your housing loan EMI which can be done using a housing loan EMI calculator as discussed below –

- In case EMI comes out to be more than your monthly budget, then you have the chance to apply for a lower loan amount which fits your monthly budget and makes EMI easily affordable.

- If you already know the EMI you have to pay each month, then you can plan your spending accordingly.

- Based on the EMI amount, you can opt for making a prepayment of your home loan in the future when you have a surplus amount.

What is the EMI for a home loan?

The EMI will vary based on the loan amount, tenure, rate of interest, and can be calculated using the home loan calculator. You can compare home loan EMI for different loan amounts and tenure and then choose the loan amount based on your repayment capacity.

How accurate is a Home Loan EMI calculator?

This online housing loan calculators use technology to calculate the results and hence, if the data entered by you is correct the results should be 100% accurate.

Will the home loan EMI remain constant or change in the future? What happens in case of an increase or decrease in the interest rate?

- Typically, the home loan EMI remains unchanged unless the customer requests for a change and the same is approved by the bank subject to its eligibility conditions (note that nominal charges may apply for effecting a customer-initiated change in EMI)

- In case the floating rate of interest on your home loan increases, the EMI will increase as per the reset frequency of your home loan.

- For partly disbursed loans availed under the tranched EMI scheme, your loan EMI will increase with each disbursement.

- You can plan your EMIs with the Home loan EMI calculator 2020.

Can I avail of income tax benefits on a home loan?

Yes. Home loans provide income tax benefits under the following sections –

| Section | Applicability and amount |

| 80C | Up to Rs. 1.5 Lakh on the home loan principal |

| 24(b) | Up to Rs. 2 Lakh on the home loan interest paid. |

| 80EEA | Additional deduction of up to Rs. 1.5 Lakh on home loan interest paid.

Only available to borrowers under the affordable housing scheme. |

Who can avail of home loans?

Home loans are available for salaried and self-employed individuals and non-individuals.

You are here to calculate the EMI (or equated monthly installment) paid by the borrower to the bank against the home loan taken from the bank. Calculate the home loan EMI by using this online Home Loan EMI Calculator.