Education Loan EMI Calculator is a financial tool that helps to calculate the EMI (or equated monthly installment) paid by the borrower to the bank against the education loan taken from Bank or any other financial institutions for a specified period.

(Calculate the EMI against the Education Loan taken from Bank or any other financial institutions by using this Education Loan EMI Calculator)

Education Loan equated monthly installment (EMI) is a fixed monthly installment paid by borrowers to the bank against the education loan taken for educational expenditure. Every month, it is due on a fixed day of the month until your loan is fully paid back.

Use this Education Loan Calculator to calculate the EMI on education loans taken from banks. This Education Loan EMI Calculator requires some data like – Your Principal Amount took from bank, Rate of Interest & Period (in No. of Months). After calculation, you will get the Equated Monthly Installments (EMI).

Information about Education Loan Calculator:

|

Table of Contents |

What is the Education Loan?

If you are planning to educate your child for higher studies and if you don’t have ready cash at your disposal, bank loans help you realise your dream. These bank loans can be repaid on a monthly basis in easy installments along with a small interest.

This Free Education Loan EMI calculator is a finance tool that will help you calculate monthly EMI as well as EMI interest payment on loans.

Features of SBI Education Loan:

- Repayment period of up to 15 years after Course Period + 12 months of repayment holiday

- Processing Charges

- Loans up to Rs. 20 lacs: NIL

- Loans above Rs. 20 lacs: Rs. 10,000 (plus taxes)

- Security

- Upto Rs. 7.5 Lacs: Only Parent/ Guardian as co-borrower. No Collateral Security or third party guarantee

- Above Rs. 7.5 Lacs: Parent/ Guardian as co-borrower and tangible collateral security

- Margin

- Up to Rs 4 Lacs – Nil

- Above Rs 4 Lacs – 5% for studies in India, 15% for studies in abroad

- Repayment will commence one year after completion of course.

- Loan to be repaid in 15 years after the commencement of repayment

- In case the second loan is availed for higher studies later, to repay the combined loan amount in 15 years after completion of the second course

- EMI Generation

- The accrued interest during the moratorium period and course period are added to the principle and repayment are fixed in Equated Monthly Installments (EMI).

- If full interest is serviced before the commencement of repayment; EMI is fixed based on principle amount only.

Eligibility for SBI Education Loan:

A term loan granted to Indian Nationals for pursuing higher education in India or abroad where admission has been secured.

Courses Covered

Studies in India

- Graduation, Post-graduation including regular technical and professional Degree/Diploma courses conducted by colleges/universities approved by UGC/ AICTE/IMC/Govt. etc Regular Degree/ Diploma Courses conducted by autonomous institutions like IIT, IIM, etc

- Teacher training/ Nursing courses approved by the Central Government or the State Government

- Regular Degree/Diploma Courses like Aeronautical, pilot training, shipping, etc. approved by Director General of Civil Aviation/Shipping/ concerned regulatory authority b. Studies abroad:

- Job oriented professional/ technical Graduation Degree courses/ Post Graduation Degree and Diploma courses like MCA, MBA, MS, etc offered by reputed universities Courses conducted by CIMA (Chartered Institute of Management Accountants) – London, CPA (Certified Public Accountant) in the USA, etc.

Studies abroad

- Job oriented professional/ technical Graduation Degree courses/ Post Graduation Degree and Diploma courses like MCA, MBA, MS, etc offered by reputed universities.

- Courses conducted by CIMA (Chartered Institute of Management Accountants) – London, CPA (Certified Public Accountant) in the USA, etc.

Expenses Covered

- Fees payable to college/school/hostel

- Examination/Library/Laboratory fees

- Purchase of Books/Equipment/Instruments/Uniforms, Purchase of computers- essential for completion of the course (maximum 20% of the total tuition fees payable for completion of the course).

- Caution Deposit/Building Fund/Refundable Deposit (maximum 10% of tuition fees for the entire course).

- Travel Expenses/Passage money for studies abroad.

- Cost of a Two-wheeler up to Rs. 50,000/-

- Any other expenses required to complete the course like study tours, project work, etc.

Loan Amount

- Studies in India

- Medical Courses: Upto Rs 30 lacs

- Other Courses: Upto Rs 10 lacs

(Higher loan limit for studies in India may be considered on cases to case basis, maximum up to Rs 50 lacs

- Studies abroad

- Up to Rs 7.50 lacs

(Higher loan limit for Studies abroad are considered under Global Ed-vantage Scheme, maximum up to Rs 1.50 Crores)

- Up to Rs 7.50 lacs

What is Education Loan EMI?

EMI is the abbreviation for Equated Monthly Installment. Education Loan EMI is the monthly repayment that the borrower should make to repay the Education loan as per schedule.

How are the borrowed amount and interest due paid through EMIs?

Each EMI repays a part of the principal i.e. the borrowed amount and the interest due on the borrowed amount. The proportion of each EMI utilised for repayment of principal and interest, however, varies over time.

Banks and financial institutions, in general, calculate EMI through a common mathematical formula. Thus, for a given loan amount, tenure and interest rate, the EMI calculated and the amortization schedule offered by banks and Non-Banking Financial Companies (NBFCs) will typically be similar. This means that pattern of reduction of principal amount through the payment of each EMI will typically follow a similar trend across all financial institutions.

It is a well-known fact that the initial EMIs contribute more towards payment of interest due as compared to the principal amount. However, during the tenure of the loan, subsequent EMIs contribute more towards repayment of the principal amount as compared to previous EMIs.

What is the benefit of calculating Education Loan EMI?

Since education loan EMI is the fixed amount that you will need to pay to the bank towards repayment of your Loan, calculating the EMI helps you to plan your monthly budget.

What is the impact of part payments on Education Loan EMI?

Part payments reduce the outstanding loan amount, which in turn reduces the interest amount due. Without changing the EMI post part payment, the contribution of EMI towards principal repayment increases. Thus the education loan gets repaid faster.

EMI Calculator for Education Loan:

An education loan EMI calculator is an effective tool that helps you in determining the amount of money you have to pay each month as installments for the education loan of your child. Our simple-to-use EMI calculator will tell you that amount in a matter of few seconds. This not only eliminates your visit to the bank but also helps a long way in arriving at a decision.

Use this Education Loan EMI Calculator to calculate the EMI on Education loan taken from a bank or any financial institution. This Education Loan EMI Calculator requires some data like – Your Principal Amount took from bank, Rate of Interest & Period (in No. of Months). After calculation, you will get the Equated Monthly Installments (EMI).

What is Equated Monthly Installment (EMI)?

Equated Monthly Installment – EMI for short – is the amount payable every month to the bank or any other financial institution until the loan amount is fully paid off. It consists of the interest on loan as well as part of the principal amount to be repaid.

The interest component of the EMI would be larger during the initial months and gradually reduce with each payment. The exact percentage allocated towards payment of the principal depends on the interest rate. Even though your monthly EMI payment won’t change, the proportion of principal and interest components will change with time. With each successive payment, you’ll pay more towards the principal and less in interest.

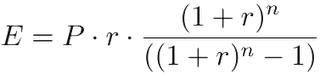

Here’s the formula to calculate EMI:

where:

E is EMI

P is Principal Loan Amount

r is the rate of interest calculated on a monthly basis. (i.e., r = Rate of Annual interest/12/100. If rate of interest is 10.5% per annum, then r = 10.5/12/100=0.00875)

n is loan term/tenure/duration in number of months

Education Loan EMI Calculator Variables:

This Education Loan Calculator for Education Loan uses four different variables that most of the calculator requires. These Education Loan EMI calculator variables are:

Principal Loan Amount: This is the amount borrowed by a borrower from the bank. If you apply for a higher loan amount, your monthly EMI will be high.

Rate of Interest: The Rate of Interest is the variable of the education loan calculator that appears as a percentage and is different for different types of loans.

Loan Period: This is the period in which you can repay your education loan. Longer loan tenure means lower housing loan EMI.

Equated Monthly Installments (EMI): Equated Monthly Installment or EMI is the amount payable every month to the bank or any other financial institution until the loan amount is fully paid off. It consists of the interest on loan as well as part of the principal amount to be repaid.

How to use the Education Loan calculator?

To use the Education Loan EMI calculator, by simply entering the loan amount, interest rate, and select the loan tenure.

The EMI calculator will show the EMIs based on the entered numbers instantly. It will change as per modification.

Anyone can calculate his EMI against the Education Loan through this online Education Loan EMI calculator available on this page with high accuracy.

Following are the steps to calculate the EMI through this calculator:

- Step 1: Enter the Principal Loan Amount that he wants to borrow from the bank as an education loan.

- Step 2: After this, fill the rate of interest of the loan he gets from his bank or financial institution. The rate of interest appears as a percentage and is different for different types of loans.

- Step 3: The next step that one has to follow is to select the period for a loan in months. This is the period in which you can repay your education loan. Longer loan tenure means lower loan EMI.

- Step 4: Thereafter putting all the above data, click the calculate button for calculation of EMI.

- Step 5: After submitting all variables required by an EMI calculator, one will get the Equated Monthly Installment or EMI against the Education Loan.

Education Loan EMI Calculator Formula:

Here’s the formula to calculate Education Loan EMI:

where:

E is EMI

P is Principal Loan Amount

r is the rate of interest calculated on a monthly basis. (i.e., r = Rate of Annual interest/12/100. If rate of interest is 10.5% per annum, then r = 10.5/12/100=0.00875)

n is loan term/tenure/duration in number of months

Education Loan Interest Rate Calculator:

Education Loan Interest rate Calculator online can help you calculate the interest rate you are eligible for and also, the total interest you will pay during the loan duration. Some of the factors that are used for interest rate calculation are:

- Occupation of the borrowers: Banks charge a slightly higher interest rate on Personal loans for self-employed as compared to that on loans for salaried borrowers.

- Amount of the Loan: This is the amount borrowed by a borrower from the bank.

- Type of loan opted for: The bank also offers different rates on its various loan schemes such as Existing Loan Borrowers, Existing Term Deposit Customers, Professional & Self Employed, NRIs, etc.

- Existing bank customers: Banks also offer lower interest to its existing bank account holders to maintain its relationship.

Advantages of using this Education Loan EMI Calculator:

There are several advantages attached to using this online Education Loan EMI calculator, which other such calculators may not provide.

Advantages of this EMI calculator are:

- Shows the results based on the fractional rate of interest.

- It helps you save time by showing the results immediately.

- It is more accurate compared to other EMI calculators.

- It helps you to determine the loan amount and tenor.

Using an EMI calculator is one of the first steps you take to apply for an education loan. The next steps involve arranging all the necessary documents and making sure you fulfill all the eligibility criteria.

FAQs about Education Loan EMI Calculator:

How can I pre-close the education loan?

You can pre-close your education loan by visiting the branch with the required set of documents. Submit the form of preclosure, pay the amount, and take the acknowledgment of the balance amount that you have paid.

How can I make sure my application is not rejected?

If you wish to have a fool-proof personal loan application procedure in place, you must consolidate all previous debts, pay all outstanding credit card bills, maintain a CIBIL score of 750 or above (the maximum score is 900), and never apply for multiple loans simultaneously.

Why should I calculate education loan EMI before taking a loan?

It is advised to calculate loan EMI prior to taking a loan. There are several benefits of calculating your education loan EMI as discussed below-

- In case EMI comes out to be more than your monthly budget, then you have the chance to apply for a lower loan amount which fits your monthly budget and makes EMI easily affordable.

- If you already know the EMI you have to pay each month, then you can plan your spending accordingly.

- Based on the EMI amount, you can opt for making prepayment of your Personal loan in the future when you have a surplus amount.

You are here to calculate the EMI (or equated monthly installment) paid by the borrower to the bank against the education loan taken from Bank. Calculate the Education Loan EMI by using this online Education Loan EMI Calculator.