SBI Car Loan EMI Calculator is a financial tool that helps to calculate the EMI (or equated monthly installment) paid by the borrower to the bank against the car loan taken from State Bank of India for a specified period.

(Calculate the EMI against the Car Loan taken from State Bank of India by using this SBI Car Loan EMI Calculator)

SBI Car Loan equated monthly installment (EMI) is a fixed monthly installment paid by borrowers to SBI against the auto loan taken for purchasing a car. Every month, it is due on a fixed day of the month until your loan is fully paid back.

Use this SBI Car Loan Calculator to calculate the EMI on car loans taken from SBI. This Car Loan EMI Calculator requires some data like – Your Principal Amount took from bank, Rate of Interest & Period (in No. of Months). After calculation, you will get the Equated Monthly Installments (EMI).

Information about SBI car loan and SBI Car Loan Calculator:

|

Table of Contents |

What is the SBI Car Loan?

SBI car loan is a secured financing option available for purchasing a new or certified pre-owned car. SBI offers customised Car loan interest rates and schemes for a special category of borrowers including Existing Car Loan Borrowers, Existing Term Deposit Customers, Professional & Self Employed, NRIs, etc.

The largest public sector bank in India also has some of the competitive interest rates for these products. SBI Car Loan interest rates are quite competitive.

Features of SBI Car Loan:

- Loan available for both salaried and self-employed.

- Borrowers within the age group of 21 and 67 years.

- Lowest Interest Rates & EMI

- Longest Repayment Tenure (7 years);

- Financing on ‘On-Road price’:

- On-Road price includes Registration, Insurance, and Extended Warranty/ Total Service Package/ Annual Maintenance Contract/ Cost of Accessories.

- Interest calculated on Daily Reducing Balance;

- For purchase of new passenger cars, Multi Utility Vehicles (MUVs) and SUVs.

- Interest rates in the range of 7.75% to 8.45%.

- Financing Up to 90% of ‘On-road Price’

- No Advance EMI

- Optional SBI Life Insurance cover available

- Low Processing charges. No hidden costs.

- No Prepayment Penalties. Reduce your interest burden by prepaying the loan.

Advantages of SBI Car Loan:

- Low-Interest rates. Interest calculation on a daily reducing balance.

- Low Processing charges. No hidden costs.

- No pre-payment penalties. The flexibility of payment of EMI anytime during the month

- The Car loan also available as an overdraft. Optimally utilize your surplus funds.

- Longest repayment tenure up to 7 years with optional SBI life cover

- Lowest EMI; No advance EMI

Eligibility for SBI Car Loan:

To avail an SBI Car Loan, you should be an individual aged 21 to 67 years, belonging to one of the following 3 categories:

| Category | Income Criteria | Max. Loan Amount |

|---|---|---|

| Regular employees of Central Public Sector Enterprises (Maharatnas/ Navratnas/ Miniratnas). Defence Salary Package (DSP), Para Military salary package (PMSP) & Indian Coastal Guard Package (IGSP) Customers and Short Commissioned Officers of various Defence establishments. | Net Annual Income of applicant and/or co-applicant if any, together with should be a minimum of Rs. 3,00,000/-. | 48 times of the Net Monthly Income. |

| Professionals, Self-employed, Businessmen, proprietary/partnership firms and others who are income tax assesses | Net Profit or Gross Taxable income of Rs. 3, 00,000/- p.a. (income of co-applicant can be clubbed together). |

4 times Net Profit or Gross Taxable income as per ITR after adding back depreciation and repayment of all existing loans. |

| Persons engaged in agriculture and allied activities. The income Tax return is not required in the case of agriculturists. | Net Annual income of the applicant and/or co-applicant together should be a minimum of Rs. 4, 00,000/-. | 3 times of Net Annual Income. |

Documents required for SBI Car Loan:

You would need to submit the following documents along with the completed application form:

Salaried

- Statement of bank accounts for the last 6 months.

- 2 passport size photographs

- Proof of Identity

- Address Proof

- Income Proof: Latest Salary Slip, Form 16

- I.T. Returns or Form 16 for the last 2 years.

- Proof of Identity : – (Copy of any one) Passport/ PAN Card/ Voters ID card/ Driving License etc. Address Proof :- (Copy of any one) Ration card/Driving License/Voters ID card/Passport /Telephone Bill/ Electricity bill/Life Insurance policy

Form 16/ITR is waived for our Salary Package customers who are maintaining their salary account with the Bank for a minimum of 12 months.

Statement of Bank Account (For six months) is waived for our Salary Package customers who are maintaining a Salary account with us.

Non-Salaried/ Professional/Businessmen

- Statement of bank accounts for the last 6 months.

- 2 passport size photographs

- Proof of Identity

- Address Proof

- Income Proof: ITR for last 2 years

- I.T. Returns or Form 16 for the last 2 years.

- Audited Balance sheet, P&L statement for 2 years, Shop & establishment act certificate/sales tax certificate / SSI registered certificate/copy of partnership.

A person engaged in agricultural and allied activities.

- Statement of bank accounts for the last 6 months.

- 2 passport size photographs

- Proof of Identity

- Address Proof

- Direct agricultural activity (crop cultivation):

Khasra/Chitta Adangal (showing cropping pattern) Patta/Khatoni (showing landholding) with photographs. All land should be on a freehold basis and ownership proof to be in the name of the borrower. - Allied agricultural activity (like Dairy, Poultry, Plantation/ Horticulture)

Documentary proof of running of the activities to be provided.

Proof of Identity : – (Copy of any one) Passport/ PAN Card/ Voters ID card/ Driving License etc.

Address Proof:- (Copy of anyone) Ration card/Driving License/Voters ID card/Passport /Telephone Bill/ Electricity Bill/Life Insurance policy

Types of SBI Car Loan:

State Bank of India offers customised Car loan interest rates and schemes for a special category of borrowers including Existing Car Loan Borrowers, Existing Term Deposit Customers, Professional & Self Employed, NRIs, etc. etc. Some of the special Car loan offers of SBI are:

- SBI New Car Loan Scheme

- Certified Pre Owned Car Loan by SBI

- SBI Car Loan For Existing Home Loan Borrowers

- SBI Car Loan For Existing Term Deposit Customers

- Car Loan For Professional & Self Employed/Businessmen having No Income Proof ( Maximum Loan Rs. 4.00 Lacs)

- SBI Rewardz For Auto Loan

- Green Car Loan: For Electric Cars

SBI Car Loan EMI:

SBI Car Loan equated monthly installment (EMI) is a fixed monthly installment paid by borrowers to SBI against the Car loan taken for purchasing a car. Every month, it is due on a fixed day of the month until your loan is fully paid back.

SBI offers Car Loans with loan periods up to 7 years, and the lowest EMI offered by the bank. The Lowest Rate of interest offered by SBI on Car Loan is 7.75% and is one of the most popular auto loans in India.

Factors Affecting SBI Car Loan EMI:

- Car Loan amount – This is the amount borrowed by a borrower from SBI. If you apply for a higher loan amount, your monthly EMI will be high.

- Interest rate – The interest rate is the rate charged by SBI on your Car loan. Higher interest rate increases your car loan EMI which will increase the total cost of the loan. The current SBI Car loan interest rate starts at 7.75%. Do complete market research and compare rates and calculate EMI online using the SBI Car loan calculator before you apply for a Car loan.

- Loan tenure – This is the period in which you can repay your Car loan in SBI. Longer loan tenure means lower car loan EMI. Generally, SBI offers car loans for a maximum tenure of 7 years.

SBI Car Loan EMI Calculator:

SBI Car Loan EMI Calculator is a financial tool that helps to calculate the EMI (or equated monthly installment) paid by the borrower to the bank against the Car loan taken from State Bank of India for a specified period.

SBI Car Loan EMI Calculator is used to calculate the EMI on Car loans taken from SBI. This Car Loan EMI Calculator requires some data like – Your Principal Amount took from bank, Rate of Interest & Period (in No. of Months). After calculation, you will get the Equated Monthly Installments (EMI).

What is EMI (Equated Monthly Installment)?

Equated Monthly Installment – EMI for short – is the amount payable every month to the bank or any other financial institution until the loan amount is fully paid off. It consists of the interest on loan as well as part of the principal amount to be repaid.

The interest component of the EMI would be larger during the initial months and gradually reduce with each payment. The exact percentage allocated towards payment of the principal depends on the interest rate. Even though your monthly EMI payment won’t change, the proportion of principal and interest components will change with time. With each successive payment, you’ll pay more towards the principal and less in interest.

SBI Car Loan EMI Calculator Variables:

This Car Loan Calculator for State Bank of India (SBI) Car Loan uses four different variables that most of the calculator requires. These Car Loan EMI calculator variables are:

Principal Loan Amount: This is the amount borrowed by a borrower from SBI. If you apply for a higher loan amount, your monthly EMI will be high.

Rate of Interest: The Rate of Interest is the variable of the Car loan calculator that appears as a percentage and is different for different types of loans. The current SBI Car loan interest rate starts at 7.75%.

Loan Period: This is the period in which you can repay your Car loan in SBI. Longer loan tenure means lower housing loan EMI. Generally, SBI offers house loans for a maximum tenure of 7 years.

Equated Monthly Installments (EMI): Equated Monthly Installment or EMI is the amount payable every month to the SBI or any other financial institution until the loan amount is fully paid off. It consists of the interest on loan as well as part of the principal amount to be repaid.

How SBI Car Loan Calculator Works?

Anyone can calculate his EMI against the SBI Car Loan through this online SBI Car Loan EMI calculator available on this page with high accuracy.

Following are the steps to calculate the EMI through this calculator:

- Step 1: Enter the Principal Loan Amount that he wants to borrow from SBI as a Car loan.

- Step 2: After this, fill the rate of interest of the loan he gets from his bank or financial institution. The rate of interest appears as a percentage and is different for different types of loans.

- Step 3: The next step that one has to follow is to select the period for a loan in months. This is the period in which you can repay your Car loan in SBI. Longer loan tenure means lower housing loan EMI.

- Step 4: Thereafter putting all the above data, click the calculate button for calculation of EMI.

- Step 5: After submitting all variables required by an EMI calculator, one will get the Equated Monthly Installment or EMI against the Car loan.

How to use the SBI Car Loan calculator?

To use the SBI Car loan EMI calculator, by simply entering the loan amount, interest rate, and select the loan tenure.

The EMI calculator will show the EMIs based on the entered numbers instantly. It will change as per modification.

SBI Car Loan EMI Calculator Formula:

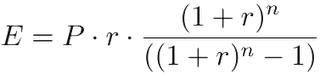

Here’s the formula to calculate car loan EMI:

where:

E is EMI

P is Principal Loan Amount

r is the rate of interest calculated on a monthly basis. (i.e., r = Rate of Annual interest/12/100. If rate of interest is 10.5% per annum, then r = 10.5/12/100=0.00875)

n is loan term/tenure/duration in number of months

SBI Car Loan Interest Rate Calculator:

SBI Car Loan Interest rate Calculator online can help you calculate the interest rate you are eligible for and also, the total interest you will pay during the loan duration. Some of the factors that are used for interest rate calculation are:

- Occupation of the borrowers: Banks charge a slightly higher interest rate on Car loans for self-employed as compared to that on loans for salaried borrowers.

- Amount of the Loan: This is the amount borrowed by a borrower from SBI.

- Type of loan opted for: The bank also offers different rates on its various loan schemes such as Existing Car Loan Borrowers, Existing Term Deposit Customers, Professional & Self Employed, NRIs, etc and Car loan with an overdraft facility, etc.

- Existing bank customers: SBI also offers lower interest to its existing bank account holders to maintain its relationship.

Advantages of using this SBI Car Loan Calculator:

There are several advantages attached to using this online SBI Car loan EMI calculator, which other such calculators may not provide.

Advantages of this EMI calculator are:

- Shows the results based on the fractional rate of interest.

- It helps you save time by showing the results immediately.

- It is more accurate compared to other EMI calculators.

- It helps you to determine the loan amount and tenor.

Using an EMI calculator is one of the first steps you take to apply for a Car loan and purchase your dream car. The next steps involve arranging all the necessary documents and making sure you fulfill all the eligibility criteria.

FAQs about SBI Car Loan EMI Calculator:

SBI finances all makes of new and used cars. The used car is financed, however, must not exceed 5 years in age. The applicant can choose any make or model for financing.

The car loan EMI is computed considering factors such as loan tenure chosen by the applicant. The EMI will be higher if a shorter tenure is chosen as compared to a long tenure.

A certain charge on the financed vehicle is submitted to the Local Transport Authorities. Your spouse will have to be the guarantor in case his/her income has also been considered for determining the loan amount. Other securities may be mandated, varying from one applicant to another.

Yes. Your spouse can join in on the car loan as a co-borrower. In that case, his/her income will be included.

The following elements are included in the ‘On-Road Price’ of the financed vehicle:

- Registration charges

- Insurance and extended warranty

- Annual maintenance contract

- Cost of accessories

- Total service package

Why should I calculate SBI loan EMI before taking a loan?

It is advised to calculate vehicle loan EMI prior to taking a loan. There are several benefits of calculating your SBI housing loan EMI as discussed below-

- In case EMI comes out to be more than your monthly budget, then you have the chance to apply for a lower loan amount which fits your monthly budget and makes EMI easily affordable.

- If you already know the EMI you have to pay each month, then you can plan your spending accordingly.

- Based on the EMI amount, you can opt for making prepayment of your car loan in the future when you have a surplus amount.

Can I prepay my SBI car loan?

SBI offers you an option of prepayment at Nil charges.

Is there any processing charge on a car loan from SBI?

Car Loan from SBI charges a processing fee of 0.51% of loan amount Minimum.₹ 1,020 and Maximum is ₹ 10,200.

You are here to calculate the EMI (or equated monthly installment) paid by the borrower to the bank against the car loan taken from State Bank of India. Calculate the car loan EMI by using this online SBI Car Loan EMI Calculator.