An Online Gratuity Calculator is financial tool used by a person for gratuity calculation for the amount he will earn on his retirement after the period of regular service in an organisation.

A person is eligible to receive gratuity only if he has completed a minimum of five years of regular service with an organisation. However, it can be paid before the completion of five years in case of the death of an employee or if he has become disabled due to an accident or disease.

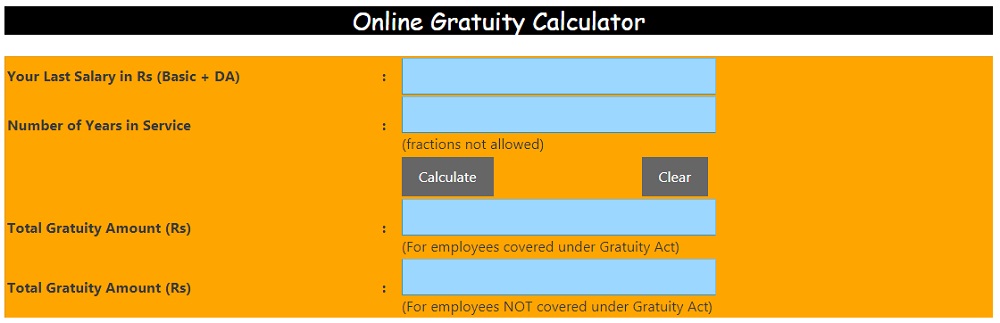

Online Gratuity Calculator

What is Gratuity Fund?

The gratuity fund refers to a sum of amount which an employer pays to his employee for the services rendered by him/her during the period of employment in that organisation.

The gratuity amount is usually paid to an employee either at the time of retirement or at the time of leaving the job provided the fulfillment of certain conditions. It can be paid before the completion of a minimum period of service requirement for gratuity in case of the death of an employee or if he has become disabled due to an accident or disease.

Factors for gratuity calculation:

Gratuity payable to the employee depends on two factors: last drawn salary and number of years of service. To calculate how much gratuity is payable, the Payment of Gratuity Act, 1972 has divided non-government employees into two categories:

- Employees covered under the Act

- Employees not covered under the Act

Gratuity calculation in India:

As per the government pensioners’ portal, retirement gratuity is calculated like this: one-fourth of a month’s basic pay plus dearness allowance drawn before retirement for each completed six monthly periods of qualifying service. The retirement gratuity payable is 16 times the basic pay subject to a maximum of Rs 20 lakh.

In case of the death of an employee, the gratuity is paid based on the length of service, where the maximum benefit is restricted to Rs 20 lakh.

| Qualifying service | Rate |

| Less than one year | 2 times of basic pay |

| One year or more but less than 5 years | 6 times of basic pay |

| 5 years or more but less than 11 years | 12 times of basic pay |

| 11 years or more but less than 20 years | 20 times of basic pay |

| 20 years or more | Half of the last salary for every completed 6 monthly periods subject to a maximum of 33 times of the last salary |

What are the eligibility criteria for an individual to receive Gratuity?

For any employee to receive a gratuity fund, he should satisfy any of the following Gratuity Eligibility criteria:

- An employee should have rendered his/her services in an organization continuously for a minimum period of 5 years with a single employer.

- An employee should be eligible for superannuation.

- If employee retires from his/her services.

- Death of the employee or an employee suffers disability due to accident or ill-health.

Categorisation of Employees as per Payment of Gratuity Act of 1972:

To calculate the gratuity amount payable to an employee, the Gratuity Act of 1972 has categorised employees into two categories namely:

- Employees who are covered under the Gratuity Act

- Employees who are not covered under the Gratuity

According to the Gratuity Act of 1972, if an organization employs a minimum of 10 persons on a single day for the last 12 months, then all the employees who work in that organization are covered under the Payment of Gratuity Act of 1972.

Once the organization comes under the purview of the act, it will always remain covered despite if the total number of employees employed in the organization fall below 10.

Unlike the EPF, the gratuity amount is paid completely by the employer and the employee will not be contributing anything towards this fund.

The employer can either offer gratuity to his/her employee either from their own pocket or they may opt for a group gratuity plan with a suitable insurance provider.

The formula for gratuity calculation:

The formula for the gratuity calculation for employees can be divided into two groups based on the organisation.

The gratuity calculation formula for employees who are covered under the Payment of Gratuity Act 1972:

There is a formula for gratuity calculation for the employees who are covered under the payment of gratuity act 1972. The formula is based on 15 days of last drawn salary for each completed year of service or part of thereof in excess of six months.

The gratuity formula is as follows:

| Gratuity Amount = (15 * last drawn salary * years of employment)/26 |

Here, last drawn salary means basic salary, dearness allowance, and commission received on sales if any.

Suppose Mr. John’s last drawn basic pay is Rs 50,000 per month and he has worked with any company for 20 years and 7 months. In this case, using the formula above, gratuity will be calculated as:

Gratuity Amount= (15 X 50,000 X 21)/26 = Rs. 6,05,770

In the above case, we have taken 21 years as a tenure of service because Mr. John has worked for more than 6 months in year. If he worked for 20 years and 5 months, then the period will be rounded off to 20 years of service while calculating the gratuity amount.

The gratuity calculation formula for employees who are not covered under the Payment of Gratuity Act 1972:

Here the amount of gratuity payable to the employee can be calculated based on half a month’s salary for each completed year. Salary here also is inclusive of basic, dearness allowance, and commission based on sales if any.

The gratuity formula to calculate the amount for those who are not covered under the Payment of Gratuity Act:

| Gratuity Amount = (15 * last drawn salary * years of employment)/30 |

In the above-mentioned example, if Mr. John’s organisation was not covered under the Act, then his gratuity will be calculated as:

Gratuity Amount= (15 X 50,000 X 21)/26 = Rs. 5,25,000

Here the number of years of service is taken on the basis of each completed year. So, since Mr. John has worked with the company for 20 years and 7 months, his tenure will be taken as 20 and not 21.

Income tax applicability on Gratuity fund:

The gratuity taxability mainly depends on the nature of the employee who is receiving the gratuity amount. They are classified into three categories namely:

- Government Employee

- Employers who are covered under the Payment of Gratuity Act

- Employers who are not covered under the Payment of Gratuity Act

| Organisation type | Gratuity tax implications |

|

Covered under the act |

Not applicable up to least of the following:

|

| Not covered under the act | Not applicable up to least of the following:

|

| Central/state government, defence, and local government authorities | Not applicable |

Gratuity Calculations in case of Death of Employee:

In case of the death of an employee, the gratuity is paid based on the length of service, where the maximum benefit is restricted to Rs 20 lakh.

| Qualifying service | Rate |

| Less than one year | 2 times of basic pay |

| One year or more but less than 5 years | 6 times of basic pay |

| 5 years or more but less than 11 years | 12 times of basic pay |

| 11 years or more but less than 20 years | 20 times of basic pay |

| 20 years or more | Half of the last salary for every completed 6 monthly periods subject to a maximum of 33 times of the last salary |

What is the use of the Gratuity Calculator?

A Gratuity Calculator is a tool that helps an individual to estimate how much of gratuity they will earn once they retire. This free gratuity calculator which can be used to calculate how much your organization owes you. All gratuity payments are controlled by the laws laid down under the Payment of Gratuity Act 1972.

If you are eligible for payment of gratuity, you must first check how much you are eligible for. Our online gratuity calculator will help you in that aspect.

Gratuity Calculator Formula:

The gratuity calculator formula for employees who are covered under the Gratuity Act:

The gratuity formula is as follows:

| Gratuity Amount = (15 * last drawn salary * years of employment)/26 |

Here, last drawn salary means basic salary, dearness allowance, and commission received on sales if any.

The gratuity calculator formula for employees who are not covered under the Gratuity Act:

Here the amount of gratuity payable to the employee can be calculated based on half a month’s salary for each completed year. Salary here also is inclusive of basic, dearness allowance, and commission based on sales if any.

The gratuity formula to calculate the amount for those who are not covered under the Payment of Gratuity Act:

| Gratuity Amount = (15 * last drawn salary * years of employment)/30 |

How to use this Online gratuity calculator?

Follow these simple steps to use this gratuity calculator.

Step 1: Keep all essential details about your employment history handy.

Step 2: Enter the basic pay + dearness allowance value and the number of years of service. After calculation, the gratuity value will be reflected within seconds.

Advantages of using this Gratuity Calculator:

FinancialCalculators.in provides you with the most useful tools in the market. Here are the reasons why our Gratuity Calculator is helpful for you.

- Data security is of paramount importance. Our servers are secure and safe for use.

- Our calculator is easy to use and you do not need any technical expertise.

- This online gratuity calculator is never wrong. You can trust our product.