EPF Calculator is an online financial tool used to calculate the return on your EPF contribution and also estimate your Employee Provident Fund (EPF) at the time of retirement.

This Online EPF calculator will help you to estimate your EPF corpus at the time of your retirement. To calculate, you just enter the current balance of your EPF account and Pension fund account, your monthly contribution, and your Employer’s contribution towards your EPF account. You have to enter an expected growth rate in your annual salary until your retirement, which will help you to increase your EPF contribution every year. Apart from that, one more important thing you have to enter is the Rate of Interest on EPF.

Employees Provident Fund Organisation of India (EFPO) controls the EPF funds deposited by both the employee and employer in a permanent account, affixed by a UAN or Unique Account Number.

What is the Employee Provident Fund (EPF)?

Employees’ Provident Fund or EPF is a popular savings scheme for working employee, that has been introduced by the EPFO under the supervision of the Government of India.

The fund is built with monetary contributions extended by employees and their employers each month. Both parties extend 12% each of the employees’ monthly salary, as their share of contribution towards EPF.

The EPF is an Exempt-Exempt-Exempt status investment instrument for the salaried class person. The contributions made by the employee eligible for tax deductions under Section 80 C, the interest earned on the total investments, and the withdrawal are exempt from the purview of taxation.

What is the Employee Pension Scheme (EPS)?

In EPS, the employer and the Central Government contribute a defined amount every month with the sole objective of providing regular pension to the employee post-retirement.

Here employees do not contribute to his own Pension Scheme, this is contributed by his employer and by the Central Government. The employer contributes 8.33% or 3.67% (as per choice) of Basic salary to the Employee Pension Scheme and the Central Government contributes 1.16% of the same. The EPS provides you with regular annuity after your retirement.

What is an EPF Calculator?

An EPF Calculator is an online financial tool used to calculate the return on your EPF contribution and also estimate your Employee Provident Fund (EPF) fund at the time of retirement. It is one step solution to all your EPF related calculation questions. It easily calculates the return on your EPF contribution within no time.

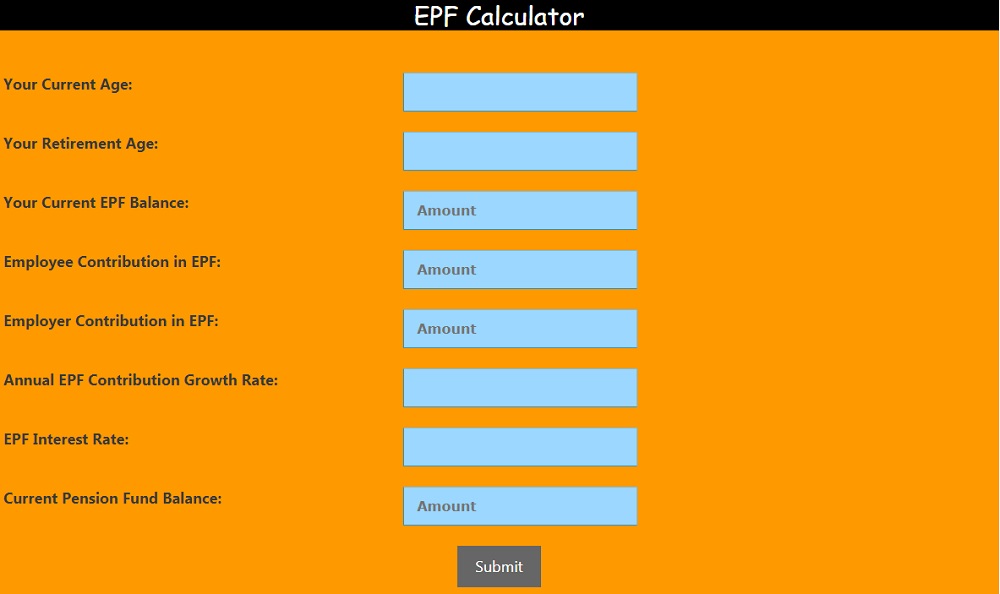

How to use this Online EPF Calculator?

Anyone can easily use this EPF calculator. To calculate, you just enter the current balance of your EPF account and Pension fund account, your monthly contribution and your Employer’s contribution towards your EPF account. You have to enter an expected growth rate in your annual salary until your retirement, which will help you to increase your EPF contribution every year. Apart from that, one more important thing you have to enter is the Rate of Interest on EPF.

The following parameters, which you have to provide are as below:

- Your Current Age

- Your Retirement Age

- Current EPF Balance

- Monthly Employee Contribution in EPF

- Monthly Employer Contribution in EPF

- Annual EPF Contribution Growth Rate or Annual Salary Increase

- EPF Interest Rate

- Current Pension Fund Balance

Your Current EPF Balance:

It is the accumulated fund in your EPF account from your past savings. The current EPF balance is the combination of your past contributions and the interest earned upon.

Monthly Employee Contribution in EPF:

It is the monthly contribution done by you in your EPF account. It is 12% of your salary (Basic+DA). Your monthly contributions towards your EPF account create a balance for yourself.

Monthly Employer Contribution in EPF:

Employee contribution in EPF is 12% of salary, but the employer’s contribution is allocated across the EPF and the EPS. The employer also bears 3 additional costs i.e. the EDLIS, the EPF admin charges, and the EDLIS admin charges.

Employer Contribution is divided as:

- 3.67% into EPF or 8.33% into EPF

- 8.33% into EPS or 3.67% into EPS

- 0.5% into EDLIS

- 0.85% for EPF Administrative Charges

- 0.01% for EDLIS Administrative Charges

Annual EPF Contribution Growth Rate (Annual Salary Increase in %):

This is also equal to your salary growth rate. In other words, enter the percent at which you expect your salary to grow yearly. This in turn will lead to growth in your as well as employer EPF contribution.

EPF Interest Rate:

You can either put the current EPF rate of interest or the rate at which you assume your EPF would deliver returns.

Current Pension Fund Balance:

Your pension fund balance is mentioned in your EPF Passbook which is part of the Employees’ Pension Scheme (EPS).