A Gratuity Calculator is financial tool used by a person for Gratuity Calculation in India for the amount he will earn on his retirement after the period of regular service in an organisation.

Online Gratuity Calculator

Gratuity calculation in India:

As per the government of India pensioners’ portal, retirement gratuity is calculated like this: one-fourth of a month’s basic pay plus dearness allowance drawn before retirement for each completed six monthly periods of qualifying service. The retirement gratuity payable is 16 times the basic pay subject to a maximum of Rs 20 lakh.

In case of the death of an employee, the gratuity calculation in India is paid based on the length of service, where the maximum benefit is restricted to Rs 20 lakh.

| Qualifying service | Rate |

| Less than one year | 2 times of basic pay |

| One year or more but less than 5 years | 6 times of basic pay |

| 5 years or more but less than 11 years | 12 times of basic pay |

| 11 years or more but less than 20 years | 20 times of basic pay |

| 20 years or more | Half of the last salary for every completed 6 monthly periods subject to a maximum of 33 times of the last salary |

What are the eligibility criteria for an individual to receive Gratuity in India?

For any employee to receive a gratuity fund in India, he should satisfy any of the following Gratuity Eligibility criteria:

- An employee should have rendered his/her services in an organization continuously for a minimum period of 5 years with a single employer.

- An employee should be eligible for superannuation.

- If employee retires from his/her services.

- Death of the employee or an employee suffers disability due to accident or ill-health.

Factors for gratuity calculation in India:

Gratuity payable to the employee in India depends on two factors: last drawn salary and number of years of service. To calculate how much gratuity is payable, the Payment of Gratuity Act, 1972 has divided non-government employees into two categories:

- Employees covered under the Act

- Employees not covered under the Act

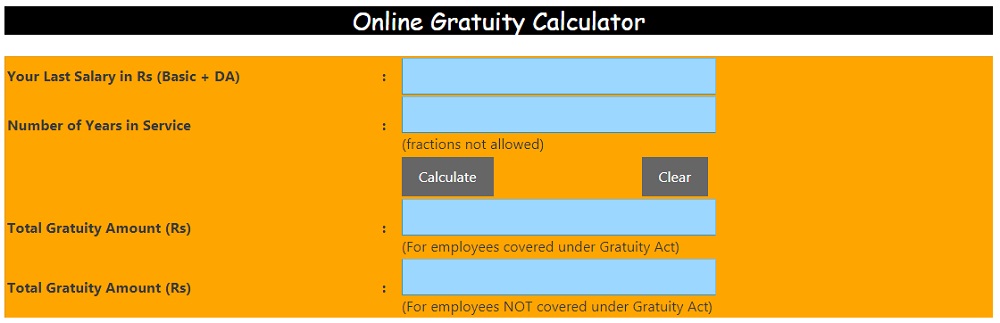

Check the Online Gratuity Calculator

Categorisation of Employees in India as per Payment of Gratuity Act of 1972:

To calculate the gratuity amount payable to an employee, the Gratuity Act of 1972 has categorised employees into two categories namely:

- Employees who are covered under the Gratuity Act

- Employees who are not covered under the Gratuity

According to the Gratuity Act of 1972, if an organization employs a minimum of 10 persons on a single day for the last 12 months, then all the employees who work in that organization are covered under the Payment of Gratuity Act of 1972.

Once the organization comes under the purview of the act, it will always remain covered despite if the total number of employees employed in the organization fall below 10.

Unlike the EPF, the gratuity amount after the gratuity calculation in India is paid completely by the employer and the employee will not be contributing anything towards this fund.

The employer can either offer gratuity to his/her employee either from their own pocket or they may opt for a group gratuity plan with a suitable insurance provider.

Gratuity Calculations in case of Death of Employee in India:

In case of the death of an employee, the gratuity amount after the gratuity calculation in India is paid based on the length of service, where the maximum benefit is restricted to Rs 20 lakh.

| Qualifying service | Rate |

| Less than one year | 2 times of basic pay |

| One year or more but less than 5 years | 6 times of basic pay |

| 5 years or more but less than 11 years | 12 times of basic pay |

| 11 years or more but less than 20 years | 20 times of basic pay |

| 20 years or more | Half of the last salary for every completed 6 monthly periods subject to a maximum of 33 times of the last salary |

Income tax applicability on Gratuity fund in India:

The gratuity tax-ability mainly depends on the nature of the employee who is receiving the gratuity amount. They are classified into three categories namely:

- Government Employee

- Employers who are covered under the Payment of Gratuity Act

- Employers who are not covered under the Payment of Gratuity Act

| Organisation type | Gratuity tax implications |

|

Covered under the act |

Not applicable up to least of the following:

|

| Not covered under the act | Not applicable up to least of the following:

|

| Central/state government, defence, and local government authorities | Not applicable |

Check the Online EPF Calculator

Formula for Gratuity Calculation in India:

The gratuity calculation formula in India for employees who are covered under the Gratuity Act:

The gratuity formula is as follows:

| Gratuity Amount = (15 * last drawn salary * years of employment)/26 |

Here, last drawn salary means basic salary, dearness allowance, and commission received on sales if any.

The gratuity calculator formula in India for employees who are not covered under the Gratuity Act:

Here the amount of gratuity payable to the employee can be calculated based on half a month’s salary for each completed year. Salary here also is inclusive of basic, dearness allowance, and commission based on sales if any.

The gratuity calculation formula to calculate the amount for those who are not covered under the Payment of Gratuity Act:

| Gratuity Amount = (15 * last drawn salary * years of employment)/30 |

Check the Online Age Calculator

Hello Friends! If you have any doubts about this post for the Gratuity Calculation in India: Eligibility criteria, Categorisation of Employees, and formula for gratuity calculation, please let me know through a comment below and if you like this post useful, please do a share on Facebook or Twitter with your friends, so that it may be useful for them also.